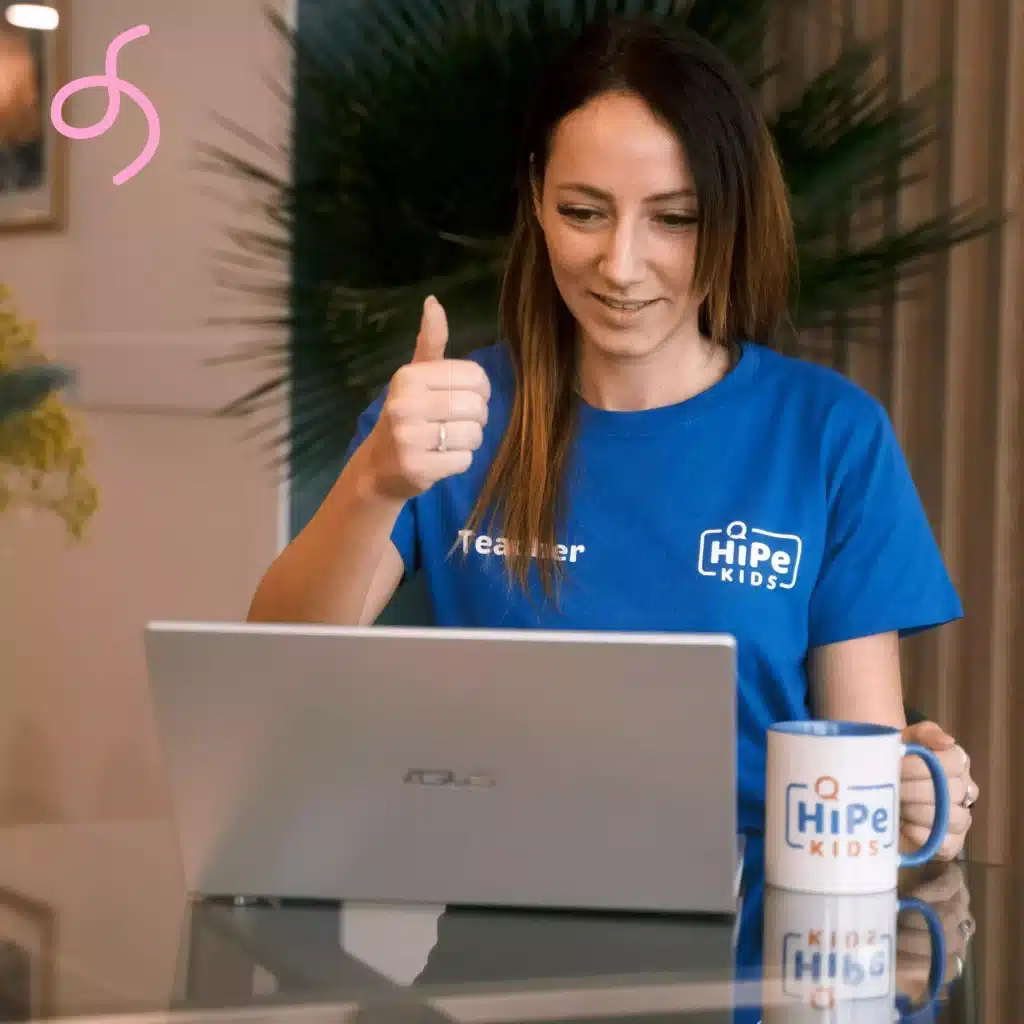

Become a teacher

Welcome teachers

We strive to be the best online English school, inspiring children around the world to speak English with confidence.

Join the HiPe Kids family. We have a growing team ready to support you.

Enjoy the flexibility and the freedom of working from your own home – when you want.

Who are we ?

HiPe Kids is an online English language school based in France. Many of our students are French speakers.

With us

- Work form your home

- Flexible working hours

- Smart calendar

- Teaching resources

- Webinars to train you

- Support from our team

We are looking for

Reliable teachers

Reliable teachers able to teach during peak days and times.

Native English speakers

Native or bilingual proficiency in English from the USA, the UK, Ireland, Canada, Australia, New Zealand or South Africa.

An international certificate

An international teaching certificate such as DELTA, CELTA or TEFL.

Teaching experience

Minimum two-years teaching experience with children. Online teaching experience would be a plus.

What teachers say

HiPe Kids teacher since 2018

HiPe Kids teacher since 2018

HiPe Kids teacher since 2021

Are you ready to join the HiPe Kids teachers ?

Frequently asked

The HiPe Kids application procedure:

Step 1: Submit your application with all required documents.

Step 2: Attend a 30-minute one-to-one interview with one of our recruiters (including a 10-minute demo-lesson).

Step 3: Attend a training session with a mentor teacher.

Step 4: Sign the contract and become part of our team!

To teach with HiPe Kids in our virtual classroom, you will need:

– A laptop or desktop computer (with Windows 8 or more / MasOXX 10.10 or more)

– A good internet connection (10Mbps or faster)

– A webcam (720p or 1020p)

– A headphone with a microphone

We pay a competitive hourly rate, based on your qualifications and experience, on receipt of your monthly invoice.

Teachers at HiPe Kids are independent contractors. No taxes are withheld by HiPe Kids. This means that you will have to file tax returns in the country where you are based.